After bouncing aggressively yesterday, cryptocurrencies are sliding again today with Bitcoin testing back below $13,000, Bitcoin Cash below $3,000, and Ethereum under $700 once again.

image courtesy of CoinTelegraph

Back down…

Bitcoin is back below $13000…though downside volume is notably lower than on Friday…

From Thursday’s close, cryptos are now down 15 to 20%…

There is still no obvious catalyst for the moves aside from a growing anxiety that HODLers may be losing faith…

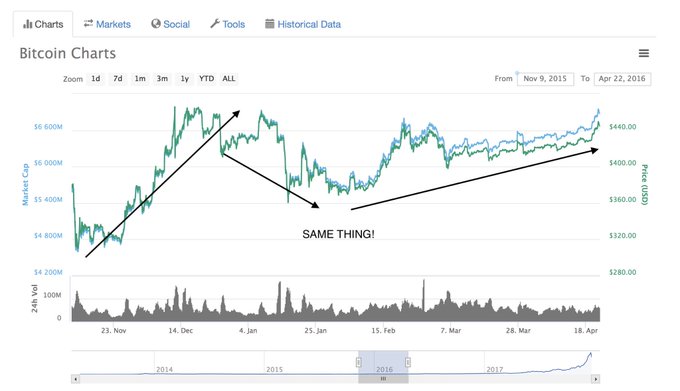

Charlie Shrem, a founding member of Bitcoin Foundation, believes that the market has already seen similar price movements and there is no reason to panic…

Others are arguing that crypto markets are broken… (via CoinTelegraph)

Cryptocurrencies have captured international attention this year. Although trading currency is nothing new, it certainly feels like an ancient concept being renewed by novel technology. The rapid price increase of almost all digital tokens, which is most noticeable in Bitcoin’s 1,600 percent improvement this year, and their surprising integration into mainstream investment markets through futures contracts, has made crypto trading an appealing pursuit for many investors. In fact, with a total market cap of more than $400 bln, crypto trading is becoming one of the hottest investment opportunities available.

Unfortunately, many traders are finding that the technological advances or even basic tradingneeds found on traditional investment exchanges are utterly lacking on crypto exchanges. This could be a big problem.

While cryptocurrencies have never been more popular or more in-demand, the exchanges that are intended to facilitate the buying and selling of cryptocurrencies are subpar and inefficient. In their current state, they are the tangible manifestation of people’s worst fears about cryptocurrencies. In general, they lack equity between exchanges, they utilize embarrassingly outdated technology, and they are infused with bad actors.

It’s clear that cryptocurrencies are going to be a significant part of the financial landscape going forward, but these problems need a solution. Perhaps by better understanding how crypto markets are broken, we can begin to find answers for their shortcomings, so that they can thrive.

Morgan Stanley, on the other hand, takes a deeper dive into the ‘value’ side of Bitcoin.

Analyst James Faucette and his team sent a research note to clients this week suggesting that the real value of bitcoin might be $0.

The report (titled “Bitcoin decrypted”) did not give a price target for bitcoin, but in a section titled “Attempts to Value Bitcoin,” he concluded, stating the somewhat obvious:

“If nobody accepts the technology for payment then the value would be 0,” Faucette suggested.

Faucette backed his argument with this chart of online retailers who accept bitcoin, titled “Virtually no acceptance, and shrinking”:

We humbly suggest that, in the same argument, if no one was forced to transact their oil requirements in USDollars, what would the world’s reserve currency be worth?

Faucette described why it is so hard to ascribe value to the cryptocurrency. It’s not like a currency, it’s not like gold, and it has had difficulty scaling.

Can Bitcoin be valued like a currency?

No. There is no interest rate associated with Bitcoin.

Like digital gold?

Maybe. Does not have any intrinsic use like gold has in electronics or jewelry. But investors appear to be ascribing some value to it.

Is it a payment network?

Yes but it is tough to scale and does not charge a transaction fee.

- Bitcoin average daily trading volume of $3bn (last 30 days) vs $5.4 trillion in the FX market.

- Est. <$300mn in daily purchase volume vs. $17bn for Visa.

However, institutions are starting to invest…

And trading and transaction volumes are soaring…

However, despite Morgan Stanley’s admittedly self-defending perspective, we leave it to John McAfee to remind cryptospace players what’s important to remember…